GST Suvidha Kendra is a one stop place to provide all GST related advisory services to the people. An Indian citizen who wants to start or expand his business can avail the help or facilities of GST Suvidha Kendra. It is not limited to providing guidance, they also help in making people aware about GST terms, registration process, return filing etc.

You can run your own GSK as your business and with time and knowledge, you can earn Rs 40,000 to Rs 1,00,000 per month from GST Suvidha Kendra. So, read this article to know about the process of earning from it and its franchise.

What is GST?

GST stands for Goods and Services Tax. GST was introduced on 29 March 2017, and came into force on 1 July 2017. It is an indirect tax that improves the process of collecting tax from citizens, and is applicable on the supply of goods and services in India. Many indirect taxes including service tax, excise tax, VAT etc. have been changed after GST came into existence.

GST Suvidha Kendra

GST Suvidha Kendra is a center where people can go to get help in their GST related work. These are authorized by the Central Government to provide various services related to GST like registration, return filing and making payments. They help taxpayers who may not be familiar with the GST system or who do not have access to the internet to complete GST related tasks easily and efficiently. These centers are established across India, and they aim to make the GST system more accessible to all.

Why is there a need for GST Suvidha Kendra?

The GST system can be complicated, and some people may find it difficult to understand and navigate. Additionally, not everyone may have access to the internet, which can make it challenging to complete GST related tasks online. GST Suvidha is authorized by the Central Government to help and provide complete guidance to the people of India.

Benefits of GST Suvidha Kendra

GSKs provide many benefits to individuals and organizations, here we discuss some of the common benefits:

Accessibility: GST Suvidha Kendra makes it easy for taxpayers to access GST related services. They can provide support to people who may not be able to access online services due to lack of resources or technical knowledge.

Capacity: These centers can help taxpayers to complete their GST related tasks efficiently and effectively. They provide one-stop solutions for various GST related queries and can help taxpayers save time and effort.

Specialization: The staff of GST Suvidha Kendra are trained and authorized by the government to provide GST related services. They have expertise in the field and can provide accurate and reliable information to taxpayers.

effective cost: The services of GST Suvidha Kendra are generally affordable, making it easier for taxpayers to access GST related services without incurring significant expenses.

Facility: This provides convenience to taxpayers as they can easily reach these centres, which are usually located in easily accessible places. They can also avail the services at a time which is convenient for them.

What is GST Suvidha Provider?

GST Suvidha Provider (GSP) is a company that provides technology-based solutions to help taxpayers comply with GST rules. GSP has been authorized by the government to develop and provide software applications that help taxpayers manage their GST related tasks. These applications are usually available online and can be accessed through a web browser or mobile app. GSPs play an important role in the GST ecosystem as they help in simplifying the GST compliance process and make it more accessible to taxpayers.

How to earn money from GST Suvidha Kendra?

There are many ways to earn from GSK. You can charge customers for their GST registration, or GST return filing. Another way to earn is by adding 15 clients every month and taking commission from them. You can earn from the one time registration process, while monthly account and return filing can increase your income from GSK.

But while providing these services it is necessary to ensure that you comply with all the relevant regulations and guidelines. By providing valuable assistance to taxpayers, you can build a loyal customer base and earn a steady income from your GST Suvidha Kendra.

It is important to get advice from someone who actually has experience in this particular field.

Here is a discussion on Quora about GST Suvidha Kendra, you can know more about this comment through this link- https://www.quora.com/How-much-profit-can-we-earn -by-opening-GST- Suvidha Kendra

Here is the link of top 3 reputed and trusted GST Suvidha Kendra Franchise providers

- https://www.gstsuvidhacenters.com/

- https://www.efficientseele.com/gst-suvidha-center.aspx

- https://www.jandigitalkendra.com/service/gst-suvidha-center/

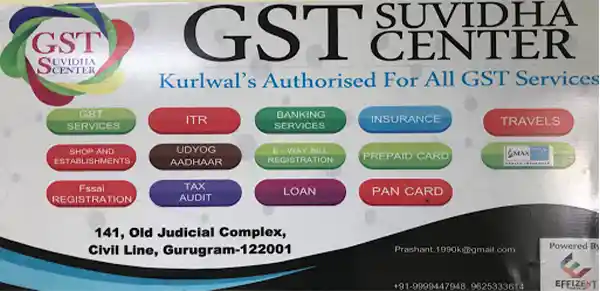

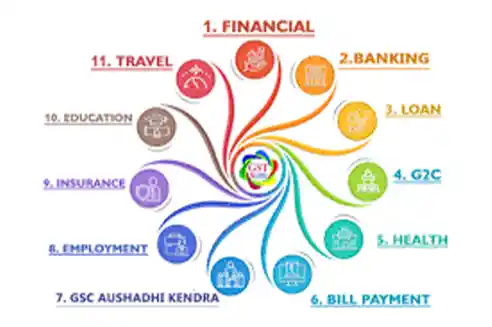

GST Suvidha Kendra Services

GSK offers a wide range of facilities to taxpayers and organizations. Here are some of them:

- GST related services: They guide people to fill GST registration form without error, how to pay return filing, ITR, DSC, etc.

- Account and Compliance: They provide hundred+ account and taxation facilities including Trademark Registration, Udyam Registration, GeM Registration, Tax Deduction Account (TAN) Registration, Balance Sheet and Profit Loss Account, etc.

- Lead Generation Course: GSK offers 100 different courses on its portal which train people on industry related needs.

- loan facility: They assist in the process of applying for or availing various types of loans, which include bank loans, home loans, business loans, loan against property, etc.

- Digital Marketing and Web Designing: They help businesses in the early stages of creating their website and logo. They also help in digital marketing.

- Insurance: Full assistance on the process of taking insurance including life insurance, vehicle insurance etc.

- legal services: They provide assistance in rental agreements, trade agreements, registration of Udyog Aadhaar and company incorporation etc.

- Taxation: Guides you to file GSTR 1, ITR and Form GSTR 4 and GSTR 6, GSTR 9 and audit tax.

- GST Payment Guidance: They assist businesses of various types and sizes in filling out tax registration forms, helping them remember tax-payment due dates, and more.

- You can contact them anytime as they provide 24/7 help desk support facility.

Apply Eligibility Criteria for GST Suvidha Kendra

For GST Suvidha Kendra Franchise, you need to pass the eligibility criteria, which is mentioned below.

- The person should be an Indian, and should have an identity card like PAN card or Aadhaar card.

- Must have a graduate degree.

- Adequate knowledge of Banking, Finance, E-Commerce etc.

- Computer and understanding of Excel is essential.

- A registration certificate provided by an insurance company is important.

- The owner should have these IT infrastructure resources including 1 printer, 2 computers, 2 Mbps internet connectivity and other necessary furniture.

- Having prior business experience is a huge advantage, but it is not essential.

- The owner should have at least 100 sq. ft. of space within 4 km radius of the business center.

- Any of these licenses should be commercial, company or firm license.

GST Suvidha Kendra by Government Registration Process

If you want to register on GSK’s portal, follow these steps.

- Visit GST Suvidha Kendra Portal: https://www.gstsuvidhakendra.net/

- fill all the details Like, name, age, gender etc.

- click on proceed button. After successfully registering and matching the criteria, you will receive further guidance from GSK’s team.

GST Suvidha Kendra Franchisee

To start your GST Suvidha Kendra Franchise you need to register on GSK Portal which is an easy and quick process. After successfully registering, you will get further assistance from their experts. Here, we have mentioned the list of top GST Suvidha Kendra Franchise.

- Masters India Private Limited

- 3i Infotech Limited

- Abhipra Capital Limited

- Adaequare Info Pvt Ltd

- Alankit Limited

- Amazon Seller Services Private Limited

- Balaji Meriline Private Limited

- BDO India LLP

- Binary Semantics Ltd

- Bodhtree Consulting Limited

- Chartered Information Systems Pvt Ltd

- CSC e-Governance Services India Limited

- Defmacro Software Pvt Ltd (Cleartax)

last word

Here, we conclude this article by providing complete details on GST Suvidha Kendra. Initiatives taken by the Government of India in this field have improved employment opportunities among the youth and provided easy tax payer support.